Competitor alerts

2 May 2024

North American advertisers shift to brand campaigns

Asset managers also focused more on the promotion of fixed income and ETFs, data by Fundamental Monitor finds

Key points:

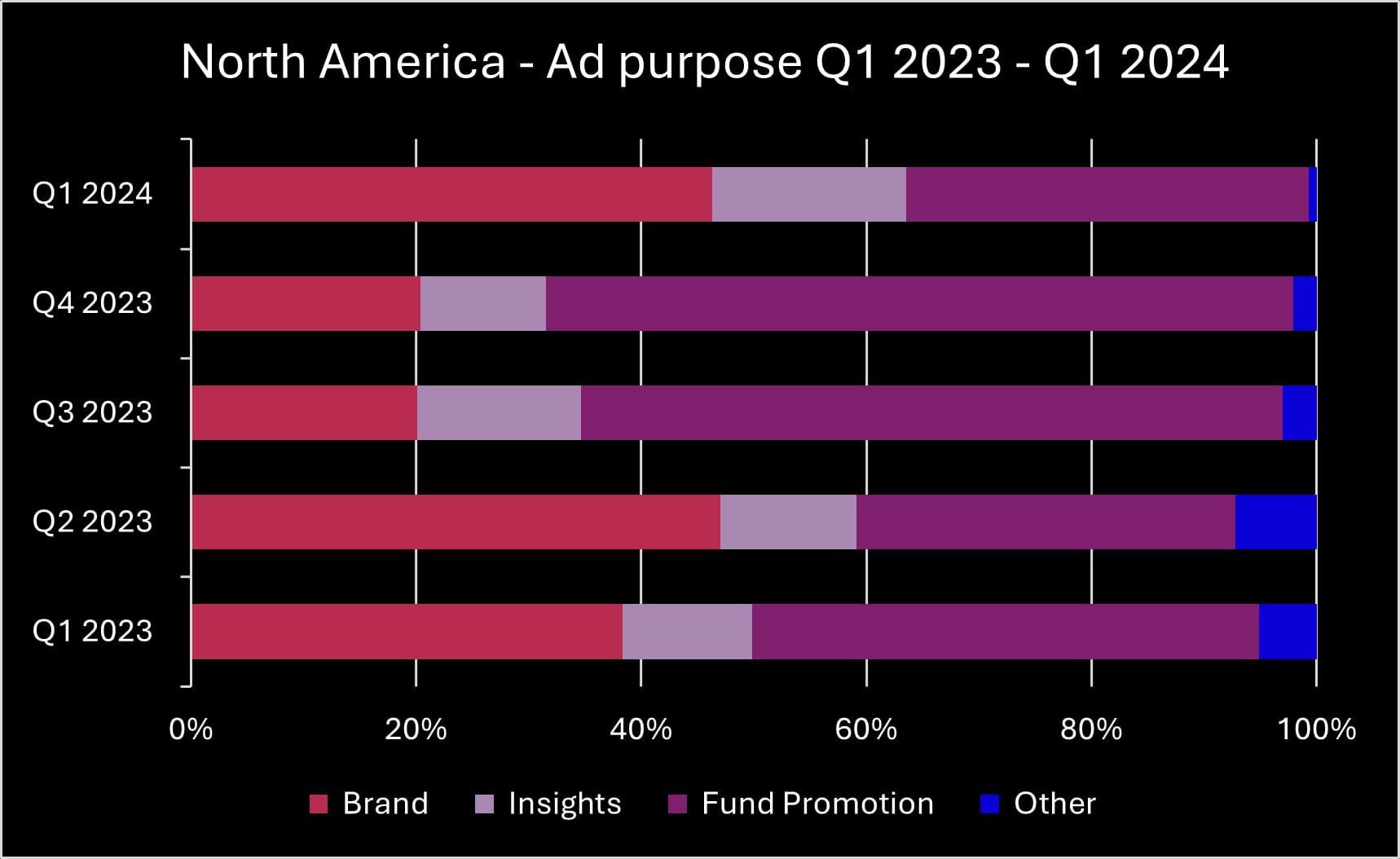

- Brand campaigns made up 46% of all advertising, while fund promotion dropped from 66% in Q4 2023 to 36% in Q1 2024.

- Asset managers dedicated a higher percentage of their North American advertising to the promotion of ETFs and fixed income compared to a quarter earlier.

- Despite fixed income and ETFs taking up a larger share of overall asset management advertising in Q1 compared to Q4, there were fewer asset managers promoting these asset classes.

After half a year of brand campaigns making up only 20% of all asset management advertising, advertisers in North America increased their brand push significantly in Q1 2024, according to data from Fundamental Monitor.

Fund promotion fell dramatically from 66% in Q4 to 36% in Q1, as asset managers focused more on brand campaigns, which made up 46% of all advertising in Q1. This was mainly due to two asset managers running major employer branding campaigns. The promotion of thought leadership saw a small increase as well and stood at 17%.

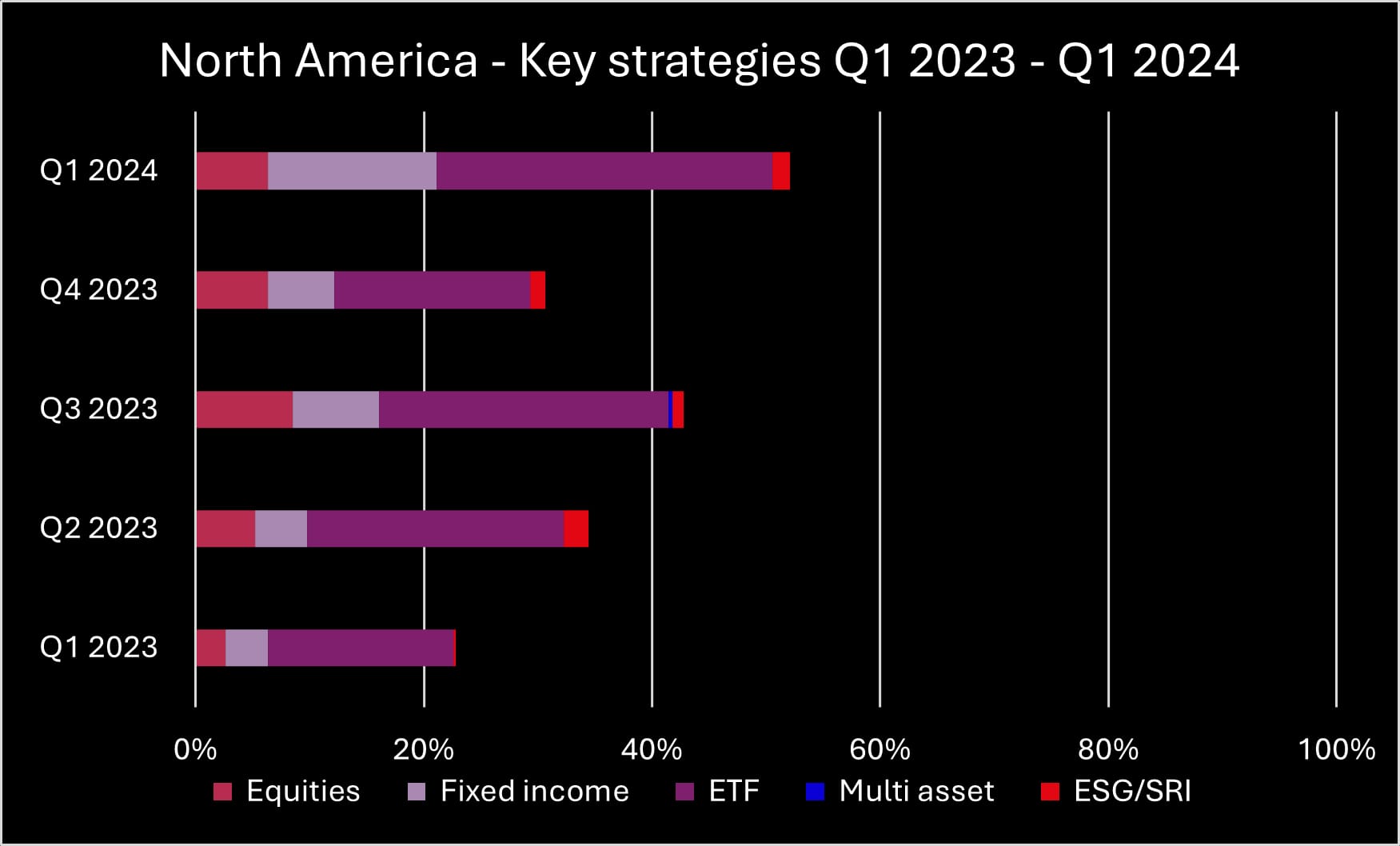

Asset managers dedicated a higher percentage of their North American advertising to the promotion of ETFs and fixed income compared to a quarter earlier. The share of advertising focused on ETFs increased from 17% in Q4 to 29% in Q1, while fixed income saw a rise of nine percentage points to 15%. Equities advertising remained flat at 6%, while ESG is still not on the minds of many advertisers in North America.

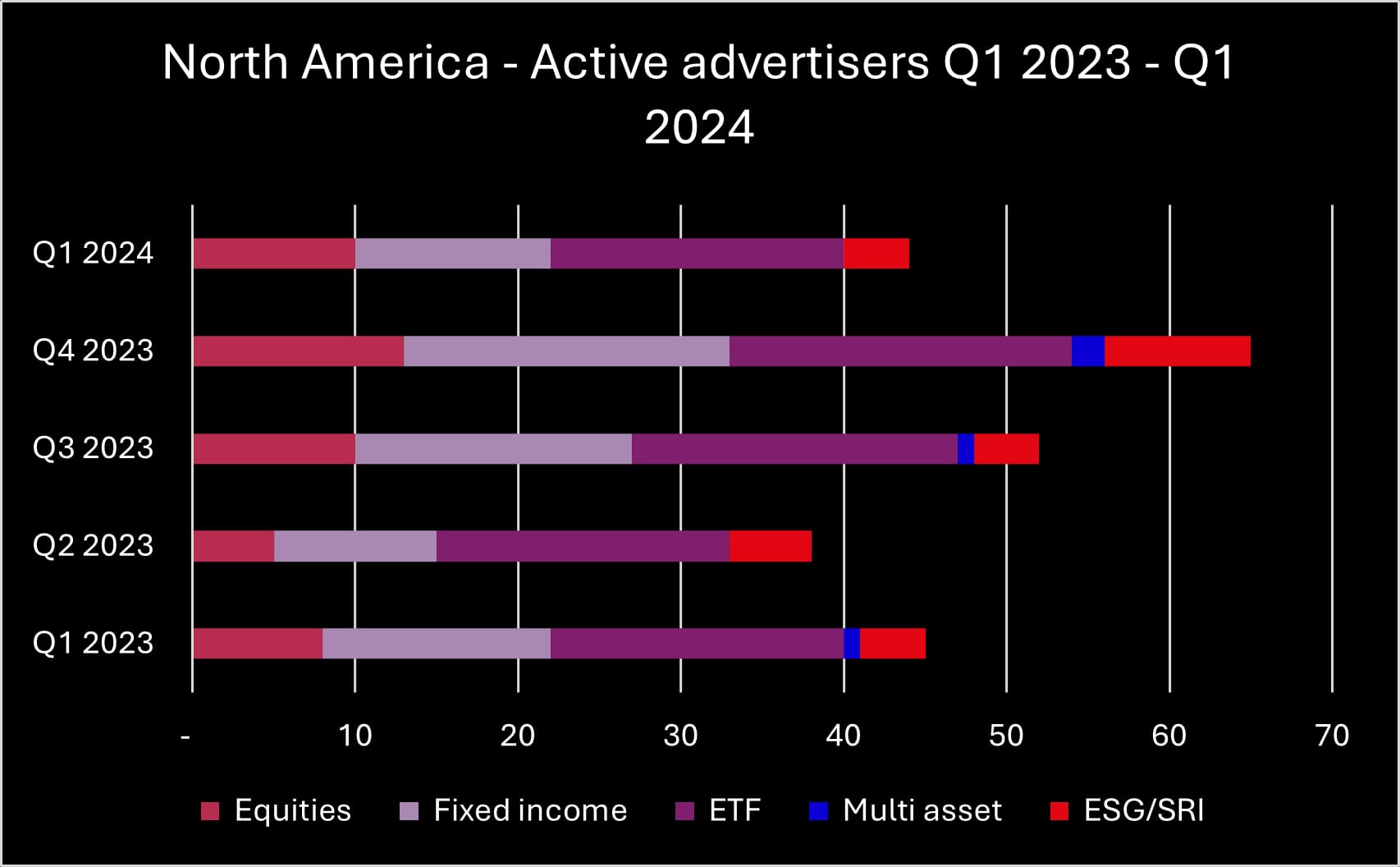

Despite fixed income taking up a larger share of overall asset management advertising in Q1 compared to Q4, there were fewer asset managers promoting this asset class (20 in Q4 compared to 12 in Q1). Similarly, the higher share of ETF advertising was carried by a small number of active advertisers, as Q1 had 18 ETF advertisers, three less than the previous quarter.

The number of equities advertisers also dropped, as did the number of advertisers promoting ESG, which dropped from nine asset managers to only four. There was no multi asset promotion at all during Q1.

Interestingly, data from Alphix Solutions, Fundamental Group’s cookie-free marketing analytics and activation business, shows that audience consumption of content on asset managers' websites on the most popular key strategies among advertisers was lower during Q1 compared to the 365-day rolling average.

Content consumption for ETFs was down quite significantly, as was consumption of fixed income content, although it was up slightly for one week in February and flat for two other weeks in the quarter. This indicates that asset managers’ increased focus on ETFs and fixed income advertising was not mirrored by an increased interest in these topics among investor audiences.

At the same time, investor interest in multi asset and ESG was up during Q1 as well, while equities content consumption was higher than the 365-day rolling average during January and February, but down slightly in the second half of March.

Below are some examples of the type of campaigns that were in market in North America during Q1 2024:

Brand campaign – MassMutual

ETFs – VanEck

Fixed income – Franklin Templeton

Similar Articles

Fewer active advertisers spent a higher advertising portion on ESG promotion in Europe

- Competitor alerts

- 3 MIN READ